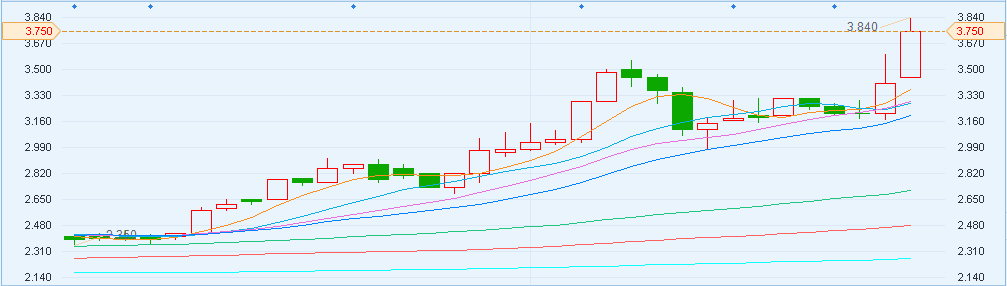

Due to capital injection from mainland China, LVGEM (China) (00095) witnessed strong upward trend in the recent two days with an intraday high of HK$3.84, creating a record high of more than two years. As of 11:13 am on January 23, LVGEM (China) share price shot up by 9.97%, quoted at HKD3.75, with the turnover of HKD39.86 million.

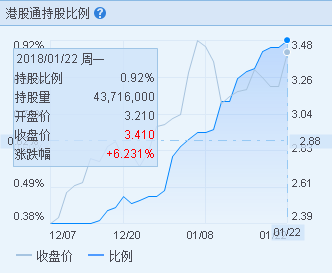

It is worth mentioning that as the enthusiasm of southbound capital at its height, LVGEM (China) has also been favored by the mainland funds. As of 22 January, the number of LVGEM (China) shares’ holding position through Hong Kong Stock Connect as a percentage of the number of shares outstanding noticeably increased to 0.92% from 0.58% at the beginning of this month.

The First Shanghai gave LVGEM (China) a “buy” rating, according to its research report released earlier. The First Shanghai pointed out that LVGEM (China) focused on core cities development in Pearl River Delta and adhered to the “two-wheel driven” model by adopting the business mix of real estate development and commercial property, while the Company’s Baishizhou project was steadily propelled.

LVGEM (China)‘s latest NAV is RMB17.8 billion; taking into account that the Company’s potential urban renewal project may thicken NAV, the estimated NAV will amount to RMB52 billion (equivalent to approximately HK$6.3 billion). LVGEM (China)’s current diluted share capital is 8.4 billion shares; taking full account of the probable additional issued shares during the proceeding of urban renewal project (assuming an additional issued shares: 1.5 billion shares), the company’s diluted NAV will be HK$6.4 per share. Therefore, First Shanghai gave LVGEM (China) a target price of HK$5.1.

Related News