LVGEM (China) is engaged in property business, mainly developing commercial and residential properties in the Pearl River Delta. The types of properties include office buildings with comprehensive services, shopping malls and hotels. Its parent company, LVGEM Group, has injected land bank into it. The injected lands are mainly located in Shenzhen, Zhuhai and Dongguan, and LVGEM (China) will begin developing properties on such sites in the future. It is expected that the company will be able to meet the sales target of HK$4.5billion this year, and this can stabilize the financial results in the second half of 2017. The company has a good prospect.

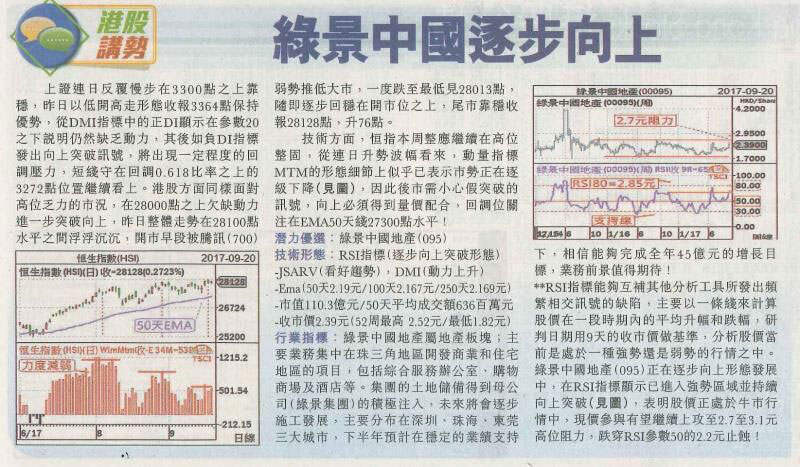

**The Relative Strength Index (“RSI”) could complement other technical indicators which may have shortcomings, namely sending mixed signals about a stock price movement. RSI reflects the amplitudes of the average increase and decrease in a share price movement over a period of time, say nine days, based on the closing prices through a line plotted on a graph. The reader of the graph can then judge whether a stock price movement indicates an uptrend or a downtrend. The RSI indicates that an upward movement in the share price of LVGEM (China) (095) is gathering momentum as the share price has been hitting new highs recently. This indicates a bullish trend. Investors who buy LVGEM (China) at the current price can expect the share price to rise to somewhere between HK$2.7 and HK$3.1, which is the temporary highest limit. They are advised to cut losses by selling the stock at HK$2.2 when RSI hits 50.

Related News